Please note as of 1st November 2024, Budget Insurance will not be offering Life Insurance or Critical Illness. If you have received a quotation and wish to purchase, please make sure this is completed before 1st November 2024.

If you are an existing Budget customer, your cover and any claim you might have are not affected.

If you have any questions, please feel free to get in touch:

General enquiries: 0330 018 8806

Claims: 0330 018 8692

Help protect your family with great value life insurance and cover up to £750,000. With Budget Life Insurance you could help make sure that your family are financially covered if you were to pass away. We’re here to help you get the cover you need to enjoy life now. You could get up to £965 cashback* by purchasing a policy. Cashback value varies depending on monthly premium.

Our policies also offer several free benefits such as terminal illness cover, will writing service (worth £150) **, write your policy into Trust and many more.

Budget Insurance are rated “excellent” by their customers on Trustpilot, so you can have peace of mind by choosing Budget Life Insurance today.

Life insurance helps to provide a financial benefit to your family if you die whilst the policy is valid. You can set the length of the policy during your application. If you pass away before the policy has ended, your family will be able to make a claim.

There a two types of life insurance that you can buy through us, Level Term and Decreasing Term (this can also be known as Mortgage Term). We’ve outlined the differences below to make your decisions easier.

With a Level Term Policy the cover amount is fixed for the length of the policy term. This means that if you pass away whilst the policy is valid, your family can claim for a set amount of money.

A Decreasing Term Policy means that the amount you are covered for reduces over time. This will mean your family will be able to claim the current value of the policy.

Your monthly payment won’t reduce on this type of policy.

We also provide both a Single Policy and a Joint Policy; this means that you can buy a policy for both you and your partner or just for you.

A Single Life Policy is life insurance for one person, which means that you’d be covered for the length of the policy.

A Joint Life Policy is life insurance for two people, but this policy will only pay out once. This will be when the first person dies, meaning the other person will receive the pay-out.

We also give you the option (subject to eligibility) to include Critical Illness Cover as an add-on to your life insurance policy. If you’re diagnosed with one of the Critical Illnesses covered under the policy, you’re able to claim for a pay-out (payable only once) that won’t impact your life insurance. Child Critical Illness Cover is also available and it covers any children whether you have them or are planning to have them in the future.

We offer our customers a free Will (worth £150**) when a valid life insurance policy is bought. This is written by a selected partner and allows you to be sure that your estate is given to the beneficiaries that you choose.

Having a Will means that you can be sure that your wishes will be taken into account in the future, as it’s a legal document. Our Will is usually worth £150, which means that if you buy Budget Life Insurance, you could be saving money on creating a Will.

Once you have purchased your Budget Life Insurance policy and have received your documents, please call our free Customer Service Line on 0330 0188806 (Mon-Fri 8am-9pm, Sat 9am-5pm, Sun 10am-3.30pm) and our team will assist you as to how you claim your free Will.

**For terms and conditions around Wills, please click here.

If you have a Single Life Insurance Policy, you may be able to write it in Trust leaving it to chosen beneficiaries. We provide a free Trust Tool** to all our customers, which means that you can be sure that the people you want to receive the proceeds of your policy do.

Some benefits of setting up a Trust include:

If you wish to consider setting up a Trust for your single life insurance policy, go to Your Account or give us a call on 0330 0188806 to apply for a form to be sent you for free. For applicable terms and conditions, please click here.

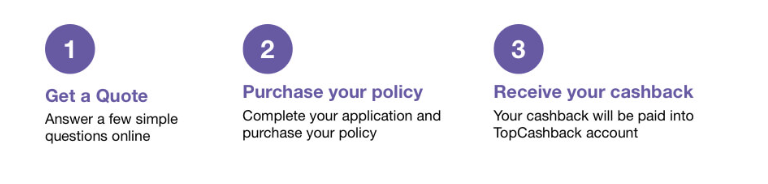

1. What will stop me getting cashback?

Using a promotional/voucher code not posted and approved by TopCashback.

2. What else is essential?

Payout is restricted to BACS only. In order to click through to this merchant and earn cashback you must have your BACS details registered.

3. Good to know

a. To be eligible for the cashback offer, the quote must be started and completed solely on TopCashback. Any quote obtained through a price comparison site and then completed through TopCashback will not be eligible for the cashback offer.

b. By using cashback, you will not be eligible for any other offers from Budget Life.

c. Your policy will need to have had six monthly payments made in six consecutive months for your cashback to be valid. Once this time period has passed, your cashback will be processed, and you should receive it within 2-8 weeks.

d. Cashback rates are subject to change both up and down.

e. Recurrences on the amount of purchases that can be made while earning cashback may be limited.

f. Budget Life Insurance cashback can be earned simply by clicking through to the merchant and shopping as normal.

g. Unless otherwise stated expect transactions for this retailer to appear within 24 hours. Your transaction will initially track at Zero and uplift upon validation.

h. Budget Life Insurance Cashback is available through TopCashback on genuine, tracked transactions completed immediately and wholly online.

4. What to do when

The vast majority of transactions from merchants track successfully, occasionally a transaction may not get reported. If you believe this to be the case, please submit a “Missing Cashback” query after 6 months of the transaction, but within 100 days of the 6-month anniversary of the policy start date, we will be unable to chase up claims older than this.

Some merchants may not be forthcoming with untracked cashback. We endeavour to chase untracked cashback but reserve the right to halt enquiries at any time. Please do not make purchase decisions based upon expected cashback as it is not guaranteed.

5. About your purchase

Budget Life love paying cashback, help them do this by completing your purchase in this visit through TopCashback. You will need to wait 6 months to ensure you are still a customer with Budget Life, after this your cashback will be processed and you should receive it within 2-8 weeks. Please note: To be eligible for the cashback offer, the quote has to be started and completed solely on TopCashback. Any quote obtained through a price comparison site and then completed through TopCashback will not be eligible for the cashback offer.

** For Terms & Conditions around the free Will and Trust Tool, please click here.

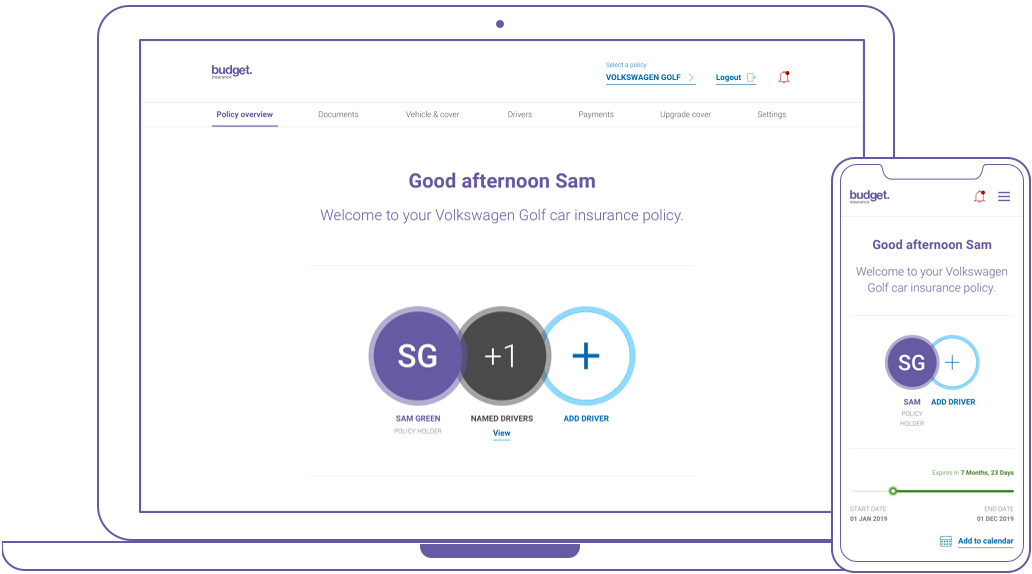

We know printed policies are likely to be misplaced and if you want to make amendments to your policy it is not always convenient to ring up a call centre. We want you to be able to look after your insurance policy in the way that suits you and at a time that is most convenient for you.

Life insurance is all about reassurance. A life insurance policy helps to provide a financial benefit to your loved ones should the worst happen.

With Budget life insurance and critical illness cover, your loved ones would receive a cash lump sum if you were to die or become too ill to work during the policy term.

It’s easy to get confused when trying to understand which type of life insurance cover is better for you. We’ve tried to make it simple so that you can be confident that you purchase the right policy for you.

There two types of life insurance that we offer at Budget are:

With a Level Term Policy the cover amount is fixed for the length of the policy term. This means that if you pass away whilst the policy is valid, your family can claim for a set amount of money agreed at the beginning of the policy.

A Decreasing Term Policy means that the amount you are covered for reduces over time. This will mean your family will be able to claim the current value of the policy. Your monthly payment won’t reduce on this type of policy, but the amount that can be claimed for will.

At Budget we provide both a Single Policy and a Joint Policy; this means that you can buy life insurance cover for both you and your partner or just for you.

At Budget you are automatically accepted and covered by Accidental Death Benefit if an immediate decision can’t be provided. This won’t cost you anything and can pay out up to £100,000 if you were to die before we reached a decision.

If you have already been accepted for a life insurance policy and a payment has been taken, you are covered immediately.

Budget Insurance not only offers great value life insurance, with cover up to £750,000.

We also understand how important it is to provide you with the highest level of support. Our UK based Customer Service Team are also on hand if you have any questions or need to make a claim – give them a call on 0330 0188806.

To make life even easier for you, we also have an online My Account available 24 hours a day, seven days a week where you can view and print all of your insurance documents.