Table of Contents

An unsecured car loan is a type of financing arrangement where the vehicle itself is not used as collateral to secure the loan. This guide aims to demystify this concept, providing a understanding of what an unsecured car loan entails, and the factors to consider when determining the most suitable option for your circumstances.

What is an unsecured loan?

An unsecured car loan is a type of personal loan used specifically for purchasing vehicles. Unlike secured car loans, where the lender can repossess the car if the borrower defaults on payments, unsecured loans rely on the borrower’s creditworthiness and financial standing as basis for approval.

Disclaimer: Budget Insurance does not offer secured loans.

Unsecured loan distinction

Unsecured car loans do not involve collateral. The lender relies on the creditworthiness, income, and the financial profile to assess the risk. Without the security of collateral, unsecured loans may have more stringent qualification criteria and may carry higher interest rates to offset the increased risk.

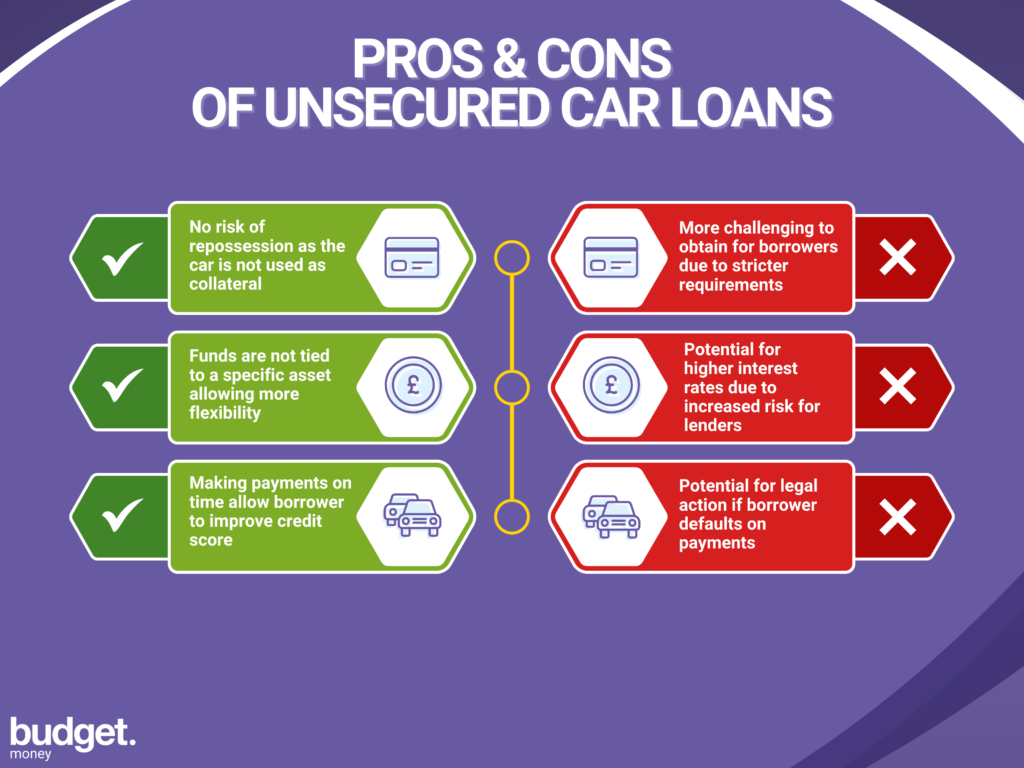

Advantages of unsecured car loans

- No risk of repossession: Since the car is not used as collateral, the lender cannot seize the vehicle if the borrower defaults on payments.

- Flexibility: Unsecured loans can provide greater flexibility in terms of how the borrowed funds are used, as they are not tied to a specific asset.

- Credit building opportunity: Making timely payments on an unsecured car loan may help establish or improve the borrower’s credit score, facilitating future financing opportunities.

Unsecured car loans are a type of unsecured personal loans, providing flexibility without the need for collateral.

Potential disadvantages of unsecured car loans

- Higher interest rates: Due to the increased risk for lenders, unsecured car loans often come with higher interest rates.

- Stricter qualification criteria: Lenders typically have more stringent requirements for unsecured loans, making it more challenging for borrowers with less-than-ideal credit scores or limited credit histories to qualify.

- Potential for legal action: While the lender cannot repossess the car, they may pursue legal action or garnish wages if the borrower defaults on payments.

It is essential to understand the terms offered by car finance providers, especially in relation to handling payment difficulties and ensuring affordability throughout the repayment period.

Factors to consider

When deciding the best loan for you, it is essential to evaluate your unique financial situation and priorities. Here are some key factors to consider:

- Credit score: Individuals with excellent credit scores may find it easier to qualify for unsecured loans

- Affordability: Unsecured loans may be preferable if the higher interest rates are still manageable within your budget.

- Risk tolerance: If the prospect of having your car repossessed is a significant concern, an unsecured loan may provide greater peace of mind, albeit at a potentially higher cost.

Who should get an unsecured loan?

An unsecured car loan can be an ideal option for individuals who possess a strong credit history and stable financial status.

This type of loan is particularly suitable for borrowers who have demonstrated responsible credit behaviour, as lenders typically rely heavily on credit scores and income stability when approving such loans.

Consequently, individuals with high credit scores and consistent income are more likely to benefit from favourable interest rates and terms.

Furthermore, an unsecured car loan can be advantageous for those who need flexibility in their financial arrangements. Since the loan is not tied to any specific asset, it offers more freedom in choosing how to utilise the borrowed funds.

It is essential for potential borrowers to assess their financial capabilities thoroughly before committing to an unsecured car loan, as the absence of collateral often results in higher interest rates.

Therefore, only those with a robust financial foundation and a clear repayment strategy should consider this financing option.

Conclusion

The world of car financing can be a complex endeavour, but understanding the nuances of unsecured car loans is an essential step towards making an informed decision.

By weighing the pros and cons, assessing your financial situation, and seeking professional guidance when necessary, you can confidently choose the financing option that aligns with your goals and preferences.

Remember, the key to a successful car purchase lies in careful planning, diligent research, and a thorough understanding of the available financing options.