Table of Contents

Determining whether a car loan is cheaper than car finance ultimately depends on your specific financial situation, preferences, and long-term goals. Both options have their advantages and disadvantages, and the most cost-effective choice may vary from person to person.

A car loan is a straightforward agreement where you borrow a lump sum from a lender to purchase your vehicle outright. You then repay the loan, along with interest, over a predetermined period.

On the other hand, car finance, also known as hire purchase (HP) or personal contract purchase (PCP), involves a different arrangement. With car finance, you don’t own the vehicle outright initially. Instead, you make monthly payments to the finance company, covering a portion of the vehicle’s cost, plus interest and fees. At the end of the agreement, you have the option to either pay a final lump sum (known as the balloon payment) to own the car or return it to the finance company.

Key takeaways

- Car loans typically have fixed interest rates for consistent monthly payments, while car finance deals often involve variable interest rates leading to fluctuating payments.

- Affordability is essential when choosing between car finance and personal loans, with car finance offering lower monthly payments but potentially resulting in higher overall costs.

- Eligibility for a car loan depends on factors such as credit score, income, employment status, and age, impacting the approval chances and potential cost savings.

- Comparing the cost comparison and payment structures between car loans and car finance can help in determining which option is cheaper in the UK.

- Keeping up with monthly repayments is essential in both car loans and car finance to avoid negative consequences.

- For car finance, you need to make sure you can afford the balloon payment if you intend to own the car outright.

Comparing the costs: Is a car loan cheaper than car finance?

The question of whether a car loan is cheaper than car finance is a complex one, as it depends on various factors. When considering car finance vs a bank loan, it’s important to understand the differences in cost and structure. To determine which option is more cost-effective for you, it’s crucial to consider the following:

- Fees and charges: Both car loans and car finance agreements may come with additional late payment fees (if they apply) and charges, such as origination fees, documentation fees, or early termination fees. These fees can add up and impact the overall cost of financing.

- Depreciation: With car finance agreements, you don’t own the vehicle outright until you make the final balloon payment. This means that the finance company factors in the vehicle’s depreciation over the agreement period, which can increase the overall cost.

- Mileage restrictions: Some car finance agreements may impose mileage restrictions, which can result in additional charges if you exceed the agreed-upon limit. Car loans typically don’t have such restrictions.

- Flexibility: Car loans offer more flexibility regarding ownership and the ability to sell or trade-in the vehicle at any time. With car finance, you may face additional fees or restrictions if you wish to terminate the agreement early.

Personal loans used for car purchases are typically unsecured loans, meaning they are not secured by the vehicle itself.

Is a personal loan cheaper than car finance?

In some cases, you may consider using a personal loan to finance your vehicle purchase instead of opting for car finance. Personal loans can be obtained from banks, credit unions, or online lenders, and they typically have fixed interest rates and repayment terms.

Personal loan car finance is a broad term that includes various methods of financing a car purchase, such as Conditional Sale, Hire Purchase, and Personal Contract Purchase.

The cost-effectiveness of a personal loan compared to car finance depends on several factors, including the interest rate, loan term, and any additional fees.

Generally, personal loans may be cheaper than car finance if you can secure a lower interest rate and avoid the additional costs associated with car finance agreements, such as mileage restrictions and balloon payments.

However, it’s important to note that personal loans are not secured by the vehicle itself, which means the lender may require you to have a higher credit score or offer collateral to qualify for favourable terms.

Loan vs finance: Which is the better option?

Determining whether a car loan or car finance is the better option for you depends on your specific circumstances and preferences. Here are some key considerations:

- Ownership: If you prefer outright ownership of the vehicle from the start, a car loan may be the better choice. With car finance, you don’t own the vehicle until you make the final balloon payment.

If you are looking to finance a brand new car, car finance options like PCP and HP may offer lower monthly payments compared to a car loan. - Long-term costs: Carefully compare the total costs, including interest, fees, and any potential penalties, over the entire loan or finance agreement term. This will help you identify the more cost-effective option.

- Flexibility: Car loans generally offer more flexibility in terms of selling or trading in the vehicle at any time, without additional fees or penalties.

- Mileage considerations: If you anticipate driving high mileage, a car loan may be preferable, as car finance agreements often impose mileage restrictions and penalties.

- Future plans: Consider your future plans for the vehicle. If you intend to keep it for an extended period, a car loan may be more suitable, as you’ll eventually own the vehicle outright.

Hidden costs to consider in car loans and car finance

- Depreciation: The value of your vehicle will depreciate over time, regardless of whether you choose a car loan or car finance. This can impact your ability to sell or trade-in the vehicle in the future. When purchasing a vehicle from a car dealer, additional costs such as dealer fees and markups can also impact the overall cost.

- Maintenance and repairs: As the vehicle ages, you’ll be responsible for covering the costs of maintenance and repairs, which can add up over time.

- Insurance costs: Both car loans and car finance agreements require you to maintain adequate insurance coverage, which will be an ongoing expense.

- Early termination fees: If you need to end your car finance agreement early, you may face significant early termination fees or penalties.

- Excess mileage charges: With car finance agreements, exceeding the agreed-upon mileage limit can result in additional charges or penalties.

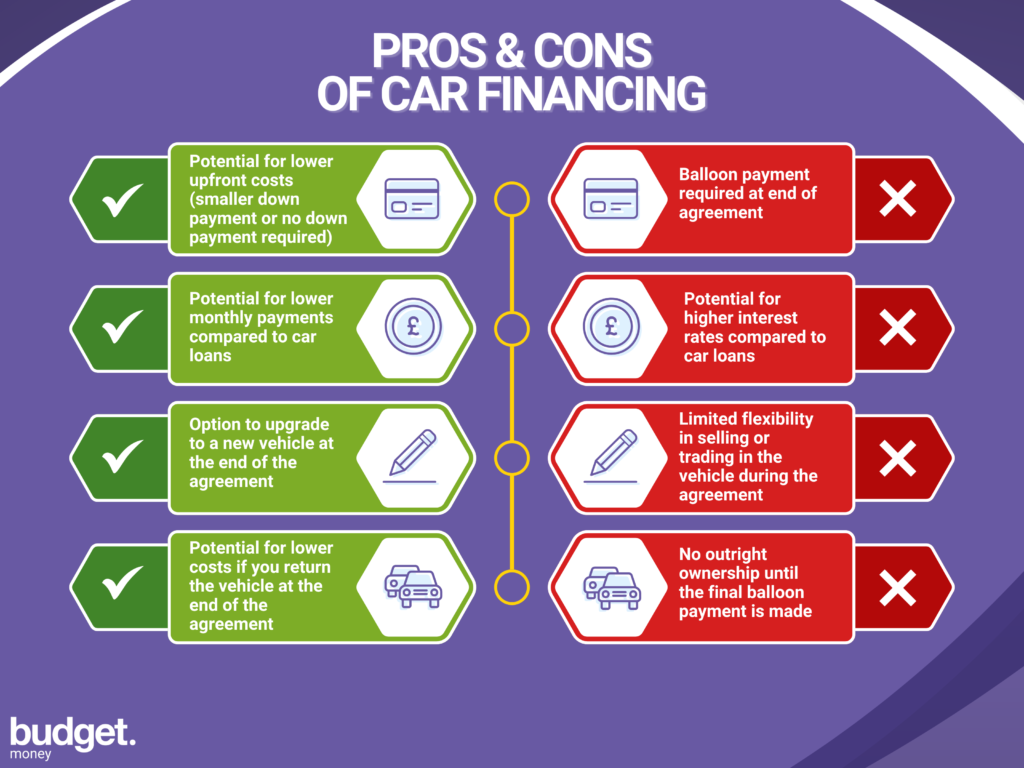

Pros and cons of car finance

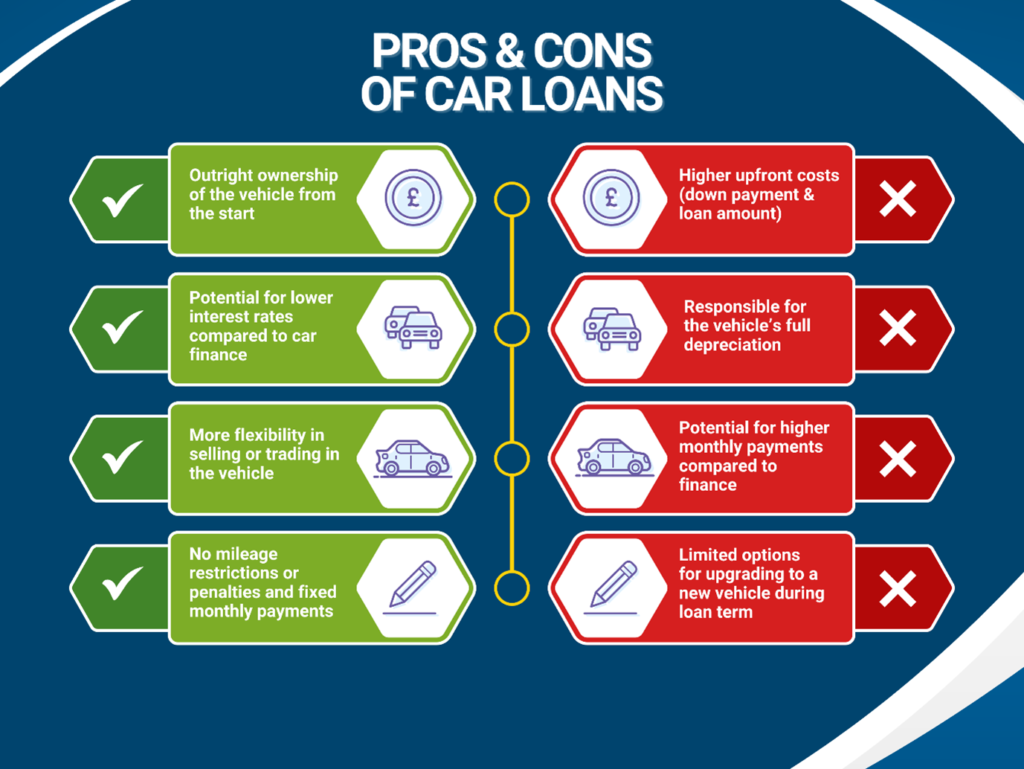

Pros and cons of car loans

Am I eligible for a car loan?

If you meet the requirements for a car loan, you can take advantage of its potential cost savings compared to car finance options in the UK. Eligibility for a car loan typically depends on factors such as your credit score, income, employment status, and age. Lenders assess these criteria to determine the level of risk involved in lending to you.

Credit score plays a significant role in determining your eligibility for a car loan. A higher credit score generally indicates to lenders that you’re a low-risk borrower, making you more likely to be approved for a loan with favourable terms.

Income is another crucial factor as it demonstrates your ability to repay the loan. Lenders often have minimum income requirements to ensure you can meet the monthly payments.

Your employment status also matters. Lenders may prefer borrowers who’ve stable jobs or a steady source of income. Age can impact eligibility, with some lenders having age restrictions for loan applicants.

By meeting these requirements, you can improve your chances of being eligible for a car loan and potentially save on costs compared to other financing options available in the UK.

A representative example personal loan might include an APR of 3.5%, a loan amount of £10,000, an agreement duration of 36 months, and monthly repayments of £292. Eligibility criteria for such loans often include a minimum credit score, proof of income, and stable employment.

Making the right financial decision

When deciding between a car loan and car finance in the UK, consider your financial situation and long-term goals. While car finance may offer lower monthly payments, a car loan may end up being cheaper in the long run due to lower interest rates.

To make an informed decision, carefully evaluate your budget, credit score, anticipated mileage needs, and future plans for the vehicle. Consider seeking advice from financial experts or using online calculators to compare the total costs of car loans and car finance agreements.

Remember, the true cost of financing a vehicle extends beyond the monthly payments. Factor in additional expenses such as insurance, maintenance, and potential fees or penalties to ensure you make the most financially responsible decision.

Frequently asked questions

You can use either a car loan or car finance to purchase a used car. Both options offer different benefits and considerations. Assess your financial situation and goals to determine which option aligns best with your needs.

When considering car finance or car loans, be aware of potential additional fees like origination fees, late payment charges, and early repayment penalties. These can affect the overall cost of borrowing.

Your credit score significantly impacts your ability to get favourable terms for car financing and car loans. Lenders use it to assess risk and determine interest rates. A higher credit score may lead to lower rates, saving you money in the long run.

When considering the type or age of a car you can purchase with a car loan or finance, restrictions may vary. Lenders commonly have guidelines on vehicle age and condition, ensuring the asset retains value. Review terms carefully.

If you’re unable to make payments on your car loan or finance agreement, you risk default. Consequences may include repossession, credit score damage, and potential legal action. Communicate with your lender to explore options and avoid negative outcomes.

Having an existing loan can significantly impact one’s ability to secure car finance. Financial institutions meticulously assess an applicant’s current debt obligations when evaluating car loan applications. For first-time buyers and young professionals, student loans or personal debts may affect their debt-to-income ratio, potentially influencing loan terms or approval chances.

Existing loan holders should be aware that multiple outstanding debts could lead to higher interest rates or reduced borrowing capacity. Retirees with ongoing mortgages or personal loans might face additional scrutiny regarding their fixed income and repayment ability.

Ultimately, while having an outstanding loan, credit card or other financial debts doesn’t automatically disqualify one from car finance, it’s a crucial factor that lenders consider in determining an applicant’s creditworthiness and loan terms.